The New Wave of Tokenized Apps

Tokens aren’t just for hype anymore — they can make apps better when used right. Three examples, a few lessons, and what I’m applying to Indexy.

I wasn’t a big fan of fungible tokens when I first joined the space in 2020. Back then, the only tokens that made sense to me were ETH and XTZ — because I needed them to do things and buy NFTs. Everything else felt unnecessary.

But over the past two years, that’s started to change. Fast.

One recent example that got me thinking: Circle’s IPO — a decentralized product going through a very centralized process. Meanwhile, more onchain apps are launching tokens in ways that feel far more open and aligned with their users.

Today, I want to share why tokens can make a lot of sense — when they’re paired with intent and purpose.

I’ll walk you through three apps I’ve been using daily — each one a great example of how to launch a token that adds real value.

In this deep dive:

Why traditional IPOs still leave many out

How tokenized apps are flipping the script

Three success stories: $Noice, $Checkr, and $QR

What tokenizing your app unlocks — for creators and for users

Bonus: a small gift for subscribers (stick around till the end!)

What Circle’s IPO Got Me Thinking About

Last week, Circle — the company behind the popular stablecoin USDC — went public. By traditional metrics, the IPO was a big success: IPO price ±$30, and moved up to +$85 on launch day, netting +141% for investors.

Impressive, especially considering how IPOs have struggled in recent years. It will likely encourage more crypto companies to explore IPOs.

But watching the process, one thing stood out to me: despite the decentralized nature of USDC, the IPO process itself remained heavily gated and institutional. Large banking players and well-connected investors dominated participation — while everyday users of USDC had no path in.

It’s a good reminder that traditional IPOs, even when used by crypto-native companies, aren’t really designed for broad, community-driven participation.

Which got me thinking: how are tokenized apps approaching this differently?

Tokenized Apps Flipping the Script

One model that feels far more open and aligned with users is emerging inside onchain apps: tokens launched with clear purpose, tied to real products and communities.

I’m not saying tokenized apps replace IPOs — they serve different needs. But in some ways, this model enables forms of funding, participation, and growth that traditional models often miss.

More onchain apps are launching tokens today — and many are finding traction beyond pure speculation. Tokens are being introduced in ways that enhance the product, engage users, and help bootstrap sustainable communities.

The systems aren’t perfect — far from it — but they do open new possibilities. Let’s take a look at a few success stories.

The Onchain Attention Machine: $QR

QR is a website launched by Jake — who was a podcast guest a few months ago — that follows the Nouns daily auction model. Each day, the winner of the auction gets their website listed in a giant QR code — visible for 24 hours. That’s it.

What began as a simple experiment has gained serious traction, with recent auctions topping $3,000.

There’s a clever twist: visitors who scan the QR code and check out the winning site can earn $QR tokens — rewarding actual engagement, not just speculation.

0xJake launched the token openly. For more than a week, it traded at a ~$40K market cap, giving early participants plenty of time to get in. Over the next three months — driven by growing interest in the auctions, rising site traffic, the Farcaster mini-app, and a smart token distribution strategy — the market cap crossed $6M. It currently sits around $5.1M.

Crypto Mindshare Analytics: $Checkr

One of the most interesting metrics in crypto today is mindshare — a popular marketing concept that asks: how many people are talking about your product or brand?

Checkr tracks the Farcaster social feed — and now the X feed as well — to surface social stats on crypto tokens: trending, most discussed, rising in conversations, and more.

$Checkr uses its token to power a more flexible subscription model. If you hold over 50,000 $Checkr tokens, you get access to the premium version. The beauty of this model is that instead of paying a monthly fee, you’re holding an asset. If you ever decide to stop using Checkr, you can simply sell your tokens.

Tomu — a long-time reader of this newsletter — launched Checkr to his Farcaster and X audience of fewer than 10,000 followers at the time. Following a similar approach to $QR, it was an open launch where anyone could (and still can) participate without barriers. The token now sits at a $1.5M market cap and has over 16,000 holders.

Reward Social Interactions: $Noice

Last but not least, Noice is a Farcaster-native system that lets anyone pay — or get paid — for their social interactions. The most common use case is tipping ($1 to $0.01, depending on how generous you’re feeling 😉) for likes, recasts, comments, or follows. Others can do the same — so depending on your activity, you can earn through “microtransactions.”

$Noice quickly became one of the go-to tokens for tipping. The team then expanded the system to support tipping with any token — turning it into a flexible distribution layer for apps and projects across the ecosystem.

A team of four — originally from India and led by srijan.eth — has built one of the most successful onchain social apps to date. $Noice currently sits at an $11M market cap (after briefly breaking $15M), but more importantly, it has already processed over 50,000 microtransactions in less than a month.

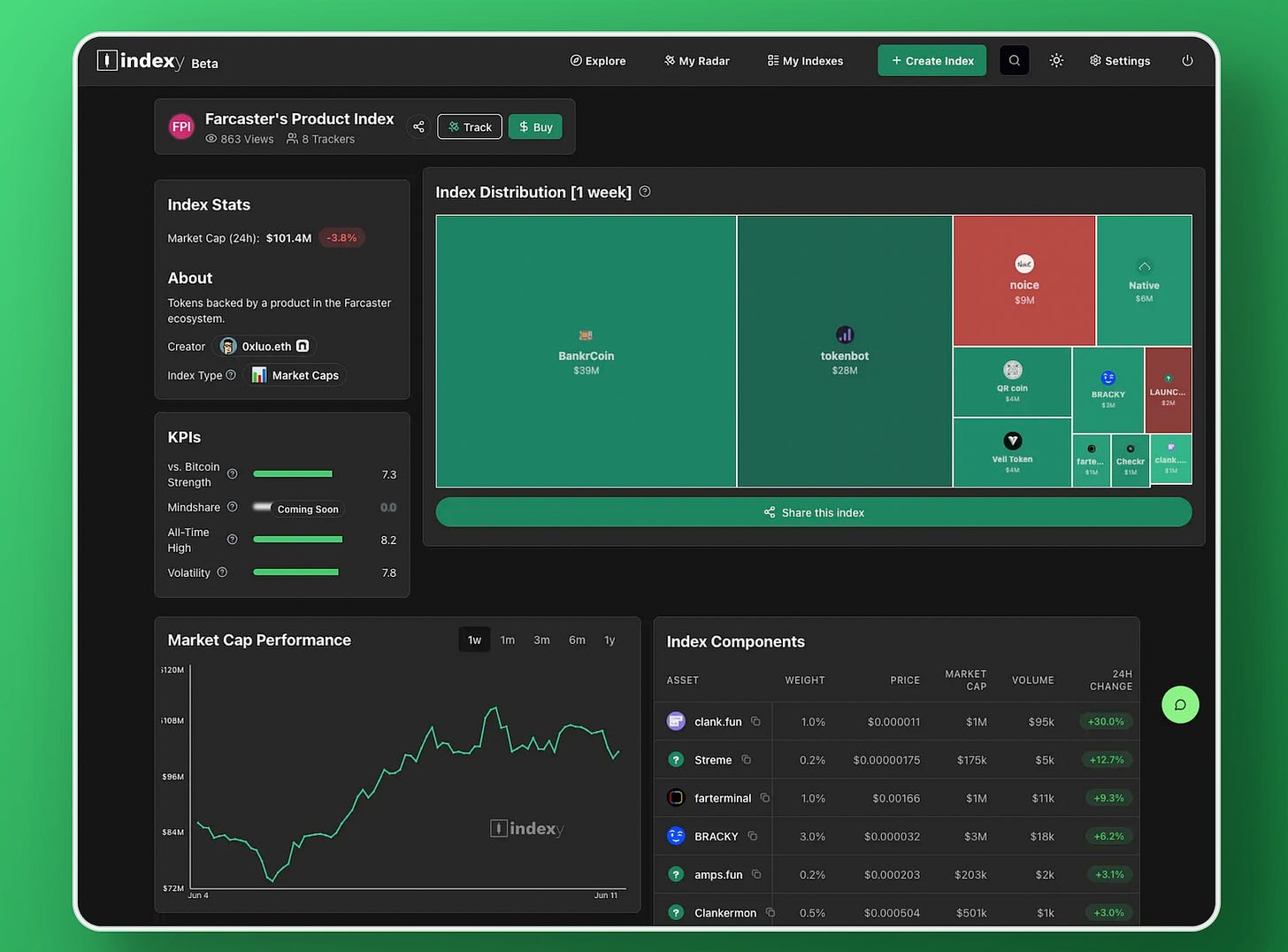

There are many more apps innovating beyond pure speculation — and one of the easiest ways to track this segment is through Indexy and the community-built indexes there.

If you’re looking to get your feet wet, the Clanker Index, the Farcaster Product Index, or the DeFi Index are great places to start.

Benefits of Tokenized Apps

So what makes this model so interesting — and worth paying attention to? When done well, tokenized apps create value for both the builders and the users. Here’s how.

What’s in it for creators?

1. Make a better product

Done right, a token should improve the user experience — not complicate it. This is where many projects stumble: they tack on a token that adds friction, attracts the wrong crowd, or turns the app into a reward-claiming machine instead of a real product.

2. Marketing and exposure

Tokens spread. When executed well (see point 1), your token shows up across social feeds, trading dashboards, social apps, and wallet activity. I’ve discovered plenty of projects this way — a token pops up in a friend’s feed, or I see it trending, and that leads me to explore the app. Some of those impressions turn into actual users.

3. Revenue stream

Not everyone has the luxury of ignoring revenue. Most creators don’t have investor backing or endless runway. They build something useful… and then face the harsh reality of server costs, storage, bandwidth, and time.

Tokens offer a way to capture a tiny slice (typically 0.1%–1%) of the transaction volume. If your app gains traction, that alone can cover operational costs — or even fund future growth. It’s a similar dynamic to NFT royalties, though with smaller margins (sub-1% vs. the 5%–20% royalty era).

If you look at the examples above — $QR, $Checkr, and $Noice — all of them are likely dealing with significant ongoing costs. Tokens give these teams a viable way to bootstrap, fund, and sustain their work over time.

What’s in it for users?

1. Tokens that actually do something

The best tokenized apps give their token a clear purpose — baked into the product itself. That’s why the examples I shared work so well:

$QR → Drive attention — or get paid for providing it

$Checkr → Unlock premium analytics

$Noice → Earn and reward social interactions — without breaking the bank

2. Earn while you use — with a twist

You’ve probably seen this in Web2: “Refer a friend and earn $50,” or airline loyalty points (though good luck actually redeeming them — I’ve tried).

The difference here? These tokens are liquid. You can use them, sell them, transfer them — and their value moves with the app’s success.

In $Noice and $Checkr, for example, you can both earn tokens through activity and use those tokens to access premium features. No lock-in. No opaque points system.

3. An option to invest — but not the whole point

Of course, speculation is part of crypto — and tokenized apps make that possible by default. But in the strongest examples, this is no longer the core value proposition.

The strongest tokenized apps are built around products people actually use — with speculation as an extra layer, not the core experience.

🎁 Small Gift for Subscribers

As you may know, I’ve been building Indexy (read my introductory post here), an analytics platform to track crypto markets with smart indices — a way to combine my passion for analytics, market intelligence, and helping people make sense of crypto markets.

In line with everything we’ve covered today, Indexy will be launching its own token — and I’m excited to experiment with some of the ideas we explored: improving the product experience, driving discovery, and creating sustainable ways to fund and grow the project.

If you are a premium member expect an email from me over the next days asking for your Base wallet - I would nerver ask you anything else, be aware of scams.

Until next time,

Kaloh

Disclaimer: As always, none of my content should be considered financial advice. This applies to all my articles and posts, and assets mentioned. Cryptocurrencies and digital assets are extremely risky and could lead to losing your investments. Always do your own research.

New subscriber here. Really enjoy your writing, great write-up. Any updates on your indexy launch? Would love to check it out.

Congratulations on your $i launch! You've put a huge amount of work in creating this & it's a really helpful & potent tool 🫡

As always, if there's anything I can do to support, jlmk 🙏

🧉