🗞️ Onchain Five

These are five things that caught my eye this week.

Hi friends,

Welcome to another edition of the Onchain Five, where I share 5 things I found interesting over the past week. Mostly crypto stuff.

Let’s get into it.

1. Coinbase Introduces Multiple Products

At their System Update event, Coinbase shared a bunch of product updates, one of the biggest announcements they’ve done in a while.

Stock trading: You can now buy stocks like Nvidia on Microsoft via tokenized stocks.

Prediction markets are now available, in a partnership with Kashi.

Perpetual trading

Token and stablecoins launchpads

Coinbase Assistant, like Coinbase Bankr

Right after the event, Brian Armstrong, Coinbase CEO, shared this question which ignited plenty of discussions.

Are you in the creator coins or the self-custodial version of Coinbase?

I personally see both as winning options, despite strong drawbacks from the comments.

You can try the Base App using my referral link.

2. Grayscale shares Dawn of the Institutional Era Report

Grayscale just dropped their 2026 outlook, and they're calling it: the four-year cycle is dead, institutional era is here. Their bet is that regulatory clarity plus macro uncertainty equals sustained bull market, not another boom-bust.

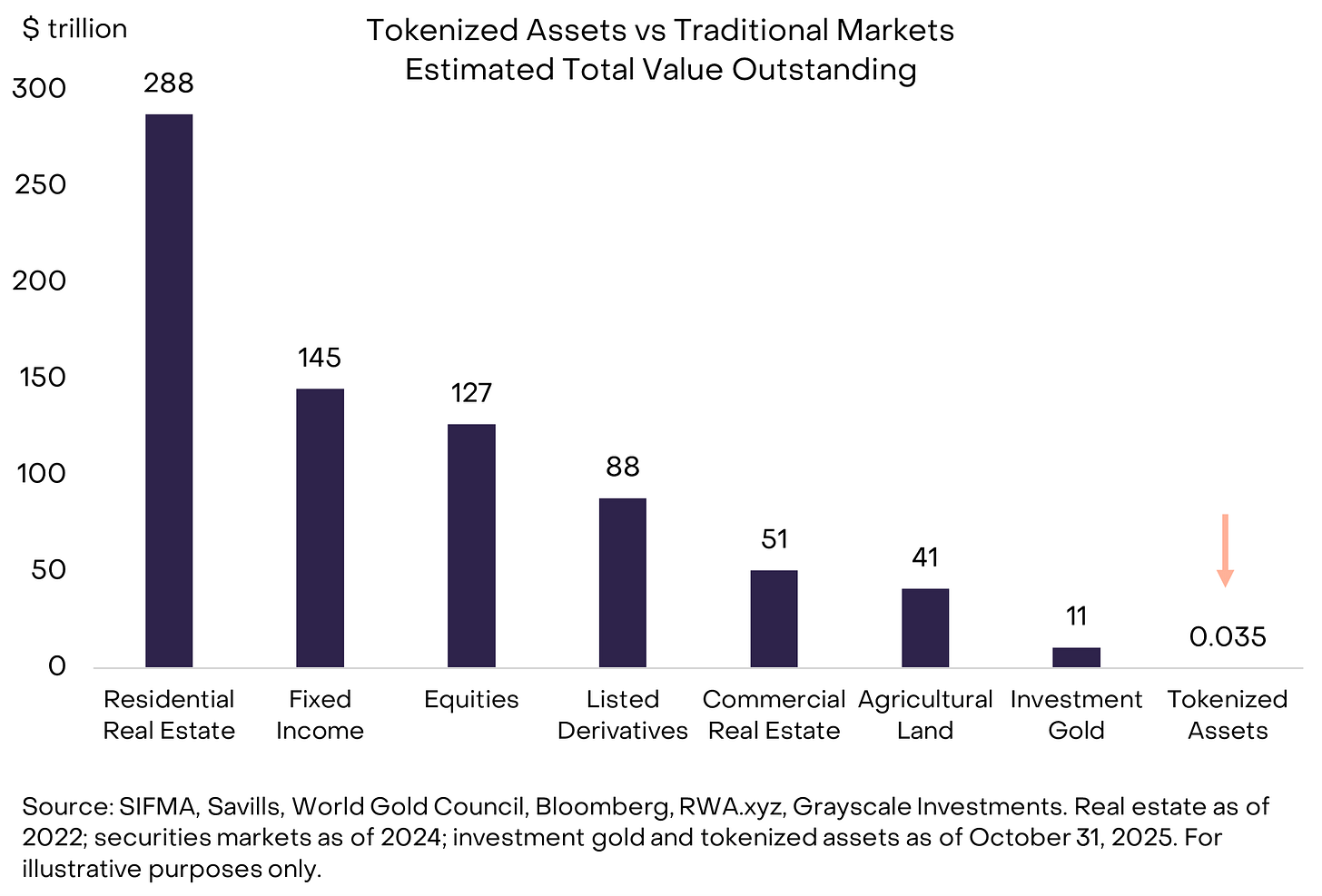

One of my favorite parts of the report is this chart. Tokenized assets are at $35B while traditional markets are measured in hundreds of trillions. Grayscale thinks this goes 1,000x by 2030 as regulations solidify and institutions stop treating blockchain like radioactive waste.

The infrastructure is already here (ETH, SOL, BNB for rails; LINK for connectivity), and the wall between that microscopic orange bar and everything else is about to crack wide open.

Source: 2026 Digital Asset Outlook: Dawn of the Institutional Era

3. Understanding Morpho Vaults

As I keep researching and learning about the future of indexes, funds, and diversification for my work at indexy, one protocol that can’t be ignored is Morpho.

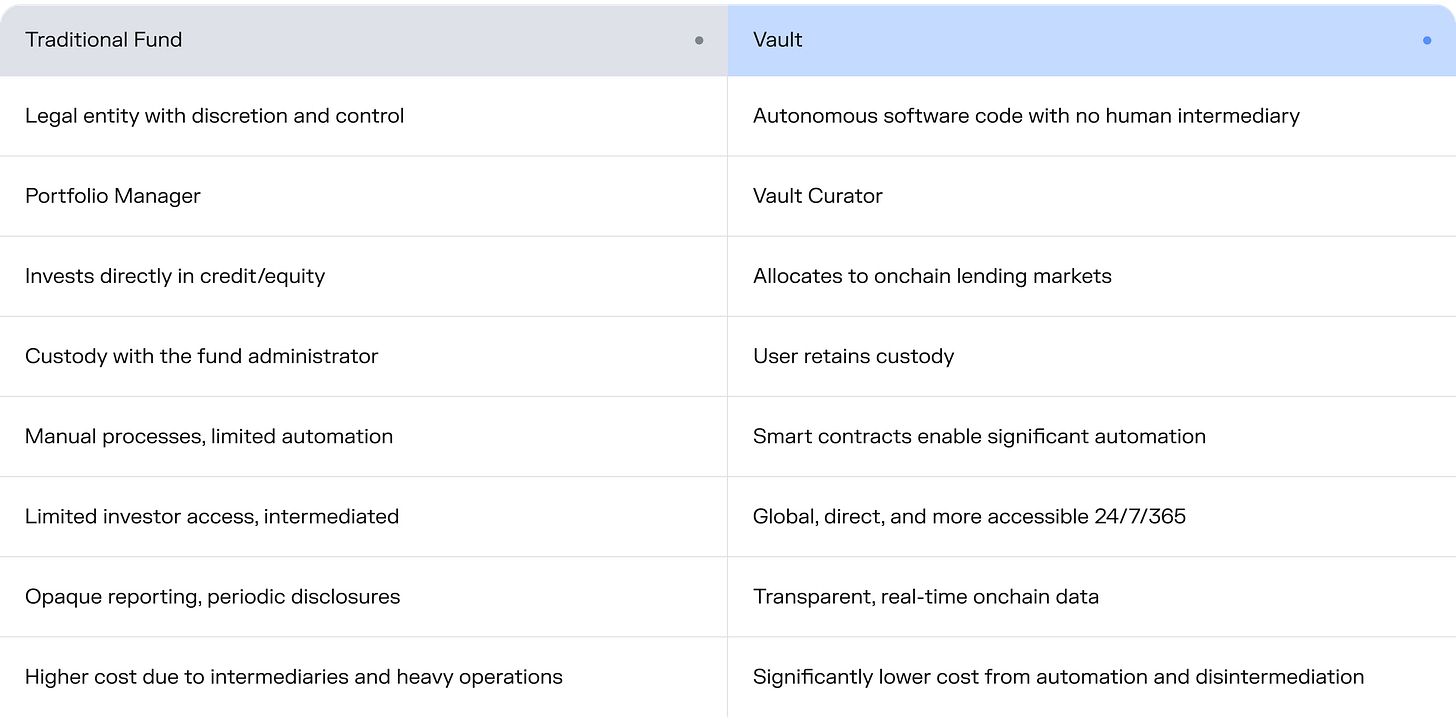

I found this article from Merlin Egalité (Morpho’s Co Founder), which goes deep into Vaults.

What Are Vaults? Think of vaults as ETFs that actually work how finance should: you deposit assets into a smart contract (not a fund manager's account), the vault auto-allocates across opportunities based on preset rules, and you keep full custody the entire time. No intermediaries, no redemption windows, no permission needed to withdraw. It's composable, programmable infrastructure that lets you deploy capital efficiently without trusting anyone with your keys. Traditional funds make you own shares in an entity that owns your assets, vaults let you own your assets while they work for you.

Source: Vaults: The Future of Noncustodial Finance

4. Rainbow gets Ready for their Airdrop

One of the most popular wallets have been preparing for the RNBW airdrop for a long time. They actually set up an scoring system in 2024, and have openly shared their plans a few months ago.

They also introduce a new legal framework, which as Mike Demarais shares in the tweet below, ensures token holders actually get paid in a potential acquisition of Rainbow in the future.

5. Product I’m Obsessed with: Whisper Flow

Going outside our blockchain bubble for this one. Whisper Flow is an app I can’t stop using… It lets you speak to anything.

Here is how I’ve been using it:

Notes on the go

Talking to my Cursor / coding environments

Dictating the newsletter

That’s it for today, if you found this recap useful, why not sharing it with your friends?

Until next time,

- Kaloh

Reminder: nothing in this newsletter is financial advice. Crypto is highly volatile and carries significant risk. Please make decisions carefully and based on your own research.