Aerodrome: Piloting liquidity, governance and emissions

I'm back, with a new newsletter format, and short overview of Aerodrome, one of the most important protocols on the Base network

Hi all,

It has been a while. As you might know, I’ve been busy building Indexy. Over the past few months I traveled to DevConnect in Buenos Aires and BaseCamp in Vermont, worked on index trading (now in closed beta), and we just passed 200,000 index views on the platform. A lot has been happening behind the scenes.

I missed writing, researching, and simply sharing what I was up to. So I’ve been thinking about how to post consistently again, and I think I’ve found the right format.

It’s simple, and hopefully valuable.

Every Friday, I’ll share a post with five things I learned during the week. These might be interesting apps, protocols, news, charts, digital collectibles, art, or anything else I found worth noting in the crypto space.

Then, ideally every week (but probably bi-weekly), I’ll share an overview of a protocol, app, or tool I’ve been using that I found interesting. These will be short by design. Simplifying is actually harder, and this format will force me to focus on the good stuff.

Everything will be free for now, since I turned off Premium when I stopped writing consistently. I might turn it back on in the future for more detailed posts, but first I need to find the rhythm again.

Let’s start with a protocol and ecosystem I’ve been studying for a bit now.

Aerodrome: Piloting liquidity, governance and emissions

Aerodrome has quickly become the breakout protocol on Base and honestly one of the fastest movers in the whole crypto ecosystem. They’re shipping nonstop: liquidity infra, swap infra, and more recently, a new token launcher, and even a Solana to Base bridge.

But for now, I want to focus on the core piece that made Aerodrome stand out, its liquidity engine and how the emissions system works.

If you aren’t familiar with liquidity pools or how liquidity provision works, I recommend reading this deep dive I wrote back in March.

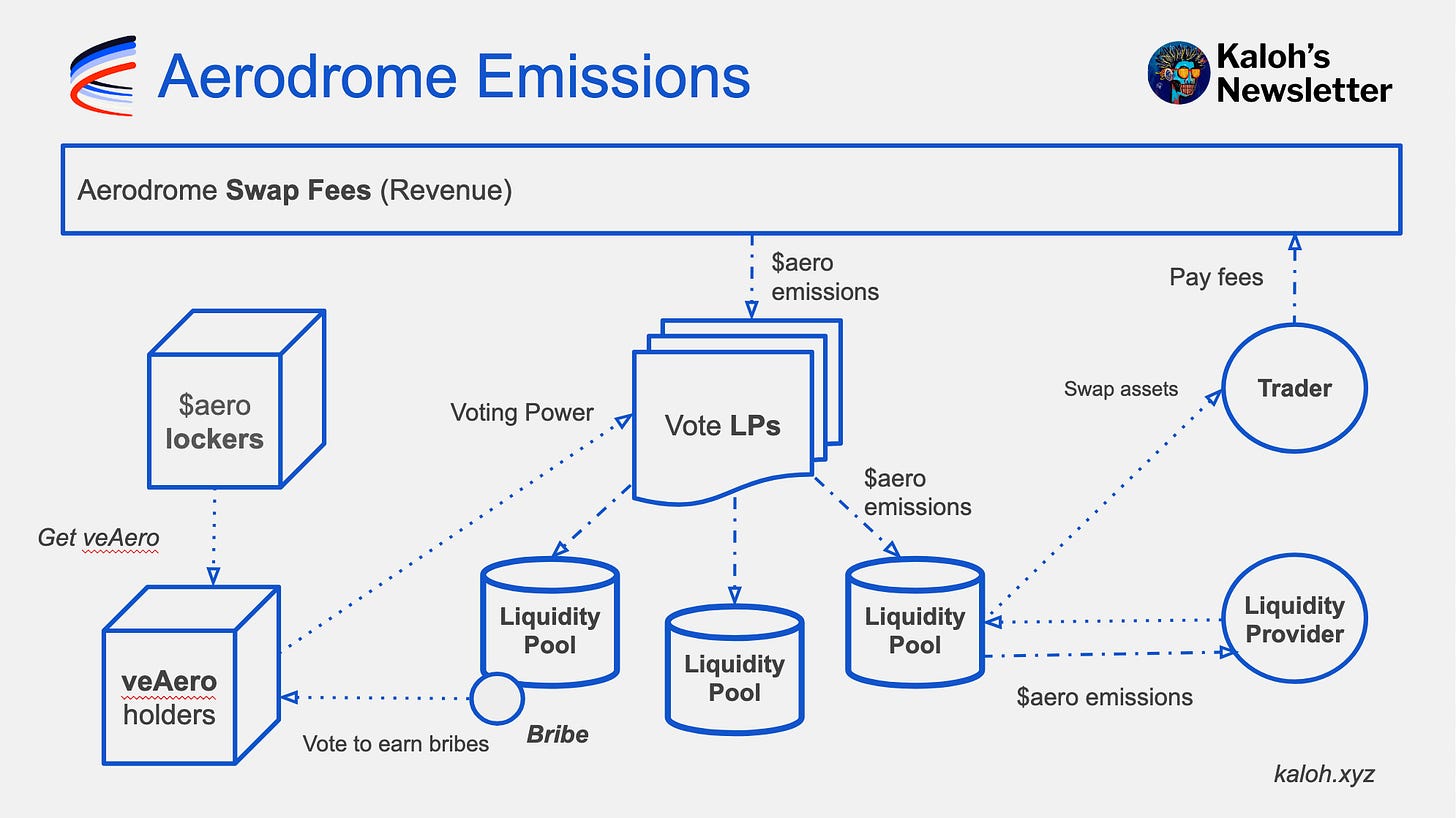

Aerodrome is a decentralized exchange and liquidity engine built on Base. It uses a vote escrow model where users (known as pilots) lock $aero tokens (the native Aerodrome token) to receive voting power, known as veAERO. Liquidity pools receive emissions of new $aero every week (called Epochs), and veAERO holders decide how those emissions are allocated among them.

Protocols can offer bribes to incentivize voters to direct emissions toward their preferred pools. Anyone can offer bribes by depositing tokens into a specific pool’s bribe contract; voters who choose that pool during the epoch receive the bribe rewards proportional to their votes.

This creates a positive feedback loop. Liquidity providers earn trading fees and $aero emissions, while veAERO voters earn fees and bribes from the pools they support. The result is an incentive system that aligns traders, liquidity providers, and protocols. Aerodrome functions as a liquidity hub for the Base ecosystem, routing emissions to the pools that show the most demand or strategic value.

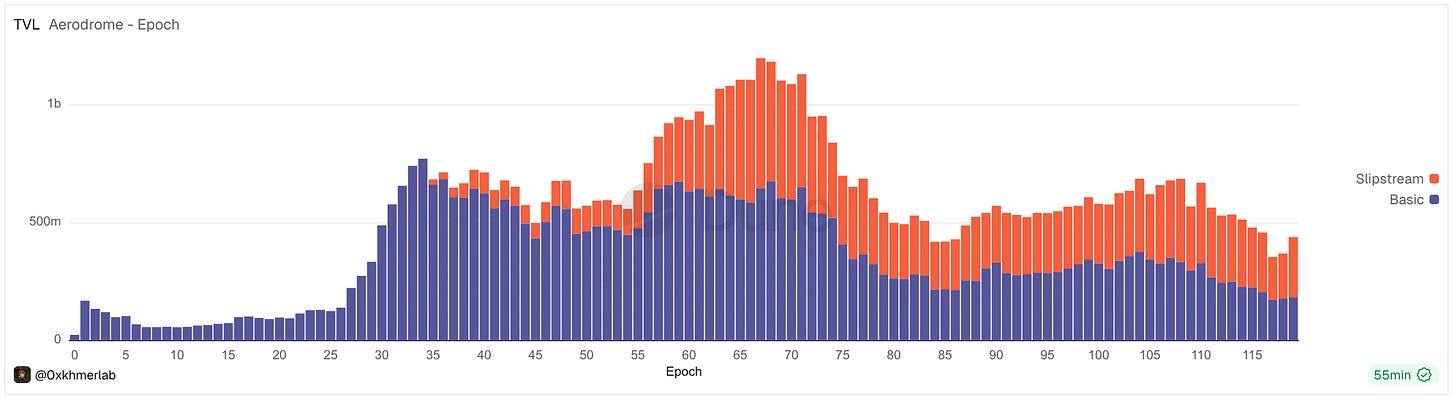

Aerodrome Stats

Current Total Value Locked: ±$440M

Cumulative Volume: ±$330B

Cumulative Swap Fees: ±$306B

What are Aerodrome Challenges?

Even though Aerodrome has proven to be highly efficient and has become the clear liquidity hub on Base, the model comes with several challenges worth highlighting.

It’s a bit complex for new users

Locking, epochs, ve voting, emissions, and bribes can be hard to grasp at first, which may limit how quickly mainstream users feel comfortable participating.Ongoing sell pressure on $aero

Rewards are paid in newly minted tokens, so the system depends on strong locking demand. If that demand slows, it can create steady sell pressure.Voting power can concentrate

Large veAero holders can have outsized influence over emissions, which can make participation feel uneven for smaller voters.Liquidity can move around quickly

Protocols may chase emissions and bribes, which can lead to liquidity shifting from pool to pool rather than building long-term depth.

What’s Next for Aerodrome

To wrap up this short overview, it’s worth looking at how Aerodrome is setting itself up for its next phase of growth.

Aerodrome has formed a direct partnership with Coinbase and powers the liquidity behind Coinbase’s onchain DEX product. In simple terms, this means anyone using Coinbase can swap any token onchain without waiting for a centralized listing. It is a massive distribution channel, though we haven’t seen its full impact yet since the DEX is still rolling out globally. As it expands to more regions and eventually supports additional networks beyond Base, this product could meaningfully rival centralized exchange volume. If that happens, Aerodrome’s role as the underlying liquidity layer becomes even more important.

Aerodrome has also begun expanding beyond its core liquidity infrastructure with two new offerings: a token launchpad and a Solana to Base bridge. Both have strong potential, but they deserve their own deep dives, so I’ll leave those for a future post.

Until next time,

- Kaloh

Reminder: nothing in this newsletter is financial advice. Crypto is highly volatile and carries significant risk. Please make decisions carefully and based on your own research.

sensational as usual